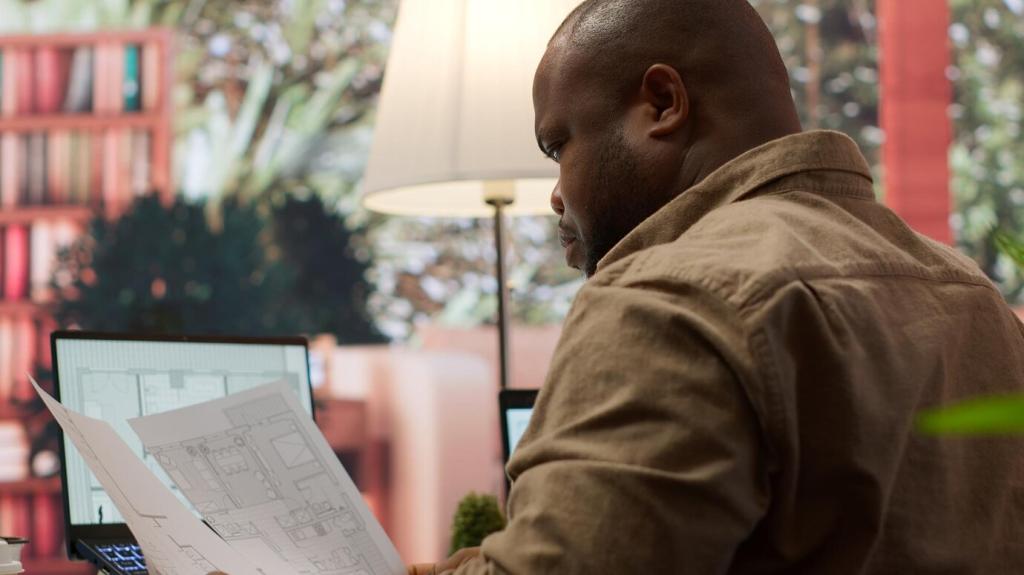

Identifying Emerging Markets for Property Investment

Today’s theme is Identifying Emerging Markets for Property Investment. Join us as we blend data, local stories, and pragmatic checklists to spot neighborhoods and cities before the headlines do. Subscribe, comment with your leads, and help this community sharpen its market radar.

Signals That Spark a Market’s Rise

01

Population Momentum and Migration Flows

Track net in-migration, not just raw population. When graduates, remote workers, and skilled trades converge, rents stabilize, vacancy tightens, and small businesses multiply. Follow school enrollments, moving-truck data, and rental searches to see momentum months before official statistics confirm the shift.

02

Job Creation and Industry Clustering

Watch for new employers, startup incubators, and supplier networks forming around anchor industries. A single factory helps, but a cluster transforms. Check job postings, coworking occupancy, and LinkedIn hiring trends to gauge durable demand that supports both multifamily absorption and owner-occupier confidence.

03

Infrastructure and Transit Catalysts

Transit extensions, fiber rollouts, and logistics hubs often arrive before widespread appreciation. One investor we know shadowed a light-rail project section by section, buying near future stations. As cranes followed rails, cap rates compressed, validating a simple rule: build your map around tomorrow’s connectivity.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Policy, Incentives, and Risk

Track upzoning initiatives, accessory dwelling unit allowances, and streamlined approvals. These signals attract builders and increase transaction volume. However, ensure timelines and community support are real, not aspirational, by attending hearings and reviewing staff reports rather than relying on rumors.

Cycle Timing and Entry Strategy

Early stage shows quirky retail openings and pop-up events. Mid stage reveals supply cranes and big-box interest. Late stage brings bidding wars and glossy branding. Match your strategy accordingly, favoring creative financing early and operational excellence when competition intensifies.

Cycle Timing and Entry Strategy

Use option periods, renovation contingencies, and performance-based price adjustments. Partner with local operators who know tradespeople and permitting paths. In uncertain pockets, flexibility beats squeezing price, helping you win deals while protecting against soft data or timeline slippage.

Cycle Timing and Entry Strategy

Pre-plan multiple exits: refinance on stabilized cash flow, sell to owner-occupiers, or package assets for small funds. Keep detailed CapEx logs and tenant improvement records to support valuations. Liquidity often arrives suddenly—be ready with clean files and compelling narratives.

Build Your Emerging-Market Watchlist

Grade each candidate market on five categories: demand growth, supply pipeline, affordability, policy clarity, and catalyst momentum. Weight scores to fit your strategy. Revisit monthly, and archive notes so your convictions compound rather than reset with each news cycle.

Build Your Emerging-Market Watchlist

Set alerts for transit tenders, industrial park approvals, and university expansions. Follow city planners on social media and subscribe to neighborhood newsletters. The earlier you see the meeting agenda, the earlier you can stake claims near tomorrow’s development hotspots.