Navigating Currency Exchange in Real Estate Deals

Today’s theme: Navigating Currency Exchange in Real Estate Deals. Whether you are wiring a deposit for a seaside condo or completing on a family home abroad, exchange rates can reshape your budget—and your peace of mind. Dive in for practical strategies, real stories, and timely tactics. Share your questions, subscribe for updates, and tell us where in the world you are buying.

Spot, Forward, and the Reality of Completion Dates

A spot rate reflects today’s market, typically settling in two business days, while your completion may be months away. That gap exposes you to swings that can inflate costs, reduce affordability, or jeopardize financing approvals unexpectedly.

The Deposit–Completion Gap: Managing a Moving Target

Paying a 10% deposit now and 90% later means your budget rides two exchange rates. A small move can translate into tens of thousands. Planning for this window early helps avoid last-minute scrambles and uncomfortable renegotiations with sellers.

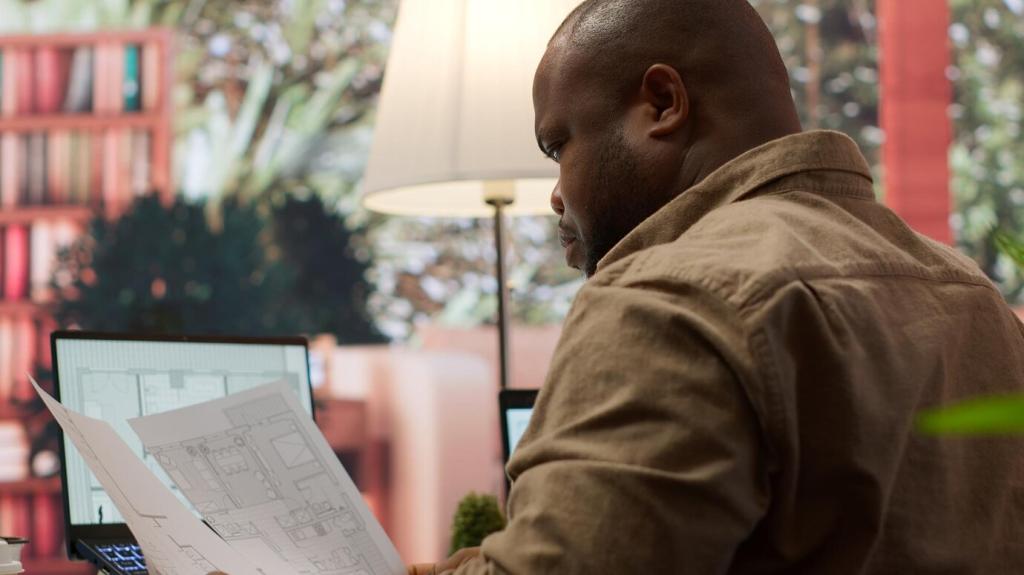

A Short Tale of Timing: Maya’s Canary Islands Purchase

Maya split her transfers across milestones and set smart alerts. A favorable dip covered her notary fees; a later hedge protected the balance. She slept better, stayed on budget, and still closed on time with zero drama at completion.

Hedging Strategies that Protect Your Property Budget

A forward contract lets you secure a known exchange rate for a future payment, aligning with completion dates. You gain predictability, simplify mortgage underwriting, and reduce stress—especially helpful when renovation and furnishing costs already stretch your plans.

Hedging Strategies that Protect Your Property Budget

Currency options can set a floor against adverse moves while allowing upside if the market improves. Collars balance cost and protection. While premiums apply, the emotional relief of defined worst-case outcomes is often worth the price during long escrows.

Contracts, Clauses, and Legal Safeguards Across Borders

01

State clearly which currency governs the price and which currency you will actually pay. If different, specify the conversion source, date, and rate mechanism to avoid disputes. Precision in wording today prevents costly misunderstandings tomorrow.

02

Some contracts include clauses addressing extreme events. While currency swings may not qualify, you can negotiate buffers, thresholds, or flexibility around completion dates. Discuss with counsel how to reflect realistic exchange risk without derailing trust between parties.

03

Expect anti–money laundering checks, proof of funds, and potential reporting at certain thresholds. Keep documentation tidy: bank statements, employment letters, asset sale records. Clear paper trails speed approvals, reduce friction, and keep focus on the home you love.

Payments, Fees, and the Hidden Friction of Cross-Border Transfers

International wires may pass through intermediaries that deduct fees en route. Confirm beneficiary details, reference fields, and expected value dates. A one-day delay can push you past closing windows, triggering penalties or awkward calls with your notary.

Payments, Fees, and the Hidden Friction of Cross-Border Transfers

Ask how escrow or notary accounts handle multi-currency receipts. Some require funds in local currency only; others accept foreign currency then convert. Align your hedge, transfer timing, and proof-of-payment so the clerk stamps your file without hesitation.

Choosing the Right Partners: Bankers, Brokers, and Advisors

Banks offer familiarity and integrated accounts; specialists may provide sharper rates, dedicated dealers, and rapid execution. Evaluate security, regulation, online tools, and service levels. Insist on transparency, written timelines, and contingency plans for urgent transfers.

Choosing the Right Partners: Bankers, Brokers, and Advisors

Foreign-currency mortgages can be attractive, but repayments fluctuate with exchange rates. Understand margin-call risk, refinancing options, and how income currency interacts with your loan. A measured approach can protect your future cash flow and peace of mind.

Budgeting Scenarios and Staying Calm When Markets Move

Model your deposit and completion at current rates, then add 5–10% adverse moves. Note the new totals and how furnishings, renovations, or fees would adjust. Pre-deciding what gives makes real decisions faster and less painful under pressure.

Budgeting Scenarios and Staying Calm When Markets Move

Use rate alerts tied to your target and worst-case levels. An alert is a cue to review, not panic. When the beep comes, consult your plan, call your advisor, and execute calmly. Discipline beats headlines every single time.

Budgeting Scenarios and Staying Calm When Markets Move

Tell us where you are buying and your target completion date. What rate would make you act today? Comment below, subscribe for fresh tips, and help another buyer learn from your journey—wins, wobbles, and all the wisdom in between.